Anil Damani, a prominent figure in Indian finance, has amassed a considerable fortune, but precisely quantifying his net worth presents a significant challenge. Unlike publicly traded companies, the majority of his wealth resides in privately held ventures, shrouding the exact figures in an air of mystery. However, by analyzing his investment strategies, key holdings, and the performance of his most prominent asset, we can gain valuable insights into the factors driving his substantial wealth.

The Pillars of Damani's Financial Empire

The cornerstone of Anil Damani's financial success is indisputably Avenue Supermarts, the parent company of the highly successful DMart supermarket chain. DMart's remarkable growth trajectory has been a significant contributor to his overall net worth. But Damani's wealth isn't solely tied to retail. His portfolio extends across diverse sectors, reflecting a shrewd long-term value investing strategy. He meticulously identifies undervalued companies with strong fundamentals, patiently accumulating wealth through sustainable growth rather than short-term market speculation. This deliberate strategy is a key driver of his financial success.

Deconstructing Damani's Investment Philosophy: A Value Investor's Approach

Damani's investment style is characterized by patience, discipline, and a keen understanding of consumer behavior. He prioritizes businesses with a sustainable competitive advantage, often referred to as a "moat" – a robust barrier protecting them from competition. This focus on long-term value creation, rather than chasing fleeting market trends, is central to his strategy. Given Damani's documented success, how can we quantify the long-term returns generated by his consistent approach to value investing? His success speaks volumes about the power of strategic long-term thinking in wealth creation.

DMart: A Retail Phenomenon Fueling Damani's Fortune

DMart's exceptional performance significantly contributes to Damani's wealth. Its winning formula hinges on strategic expansion, streamlined operations, and consistent profitability. Targeting price-conscious consumers with a focus on essential goods, DMart has cultivated a strong market presence across key regions. Maintaining cost-effective business practices enables competitive pricing while securing healthy profit margins. While not the sole source, DMart’s success is undeniably a major component of Damani’s financial standing.

The Elusive Nature of Net Worth Estimation: A Transparency Challenge

While DMart provides a significant indicator of Damani's net worth, it's crucial to remember that this just represents a fraction of his holdings. Pinpointing the value of his investments in privately held companies is significantly more complex. The lack of publicly available data related to these investments makes any precise estimation inherently challenging, meaning that any estimates widely circulated must be viewed with a degree of skepticism.

Navigating the Volatility of Net Worth: A Dynamic Landscape

It's imperative to remember that net worth is not a static figure; it fluctuates constantly based on various market forces. Market volatility, economic shifts, and global events all impact asset valuations. Any attempt to declare a precise net worth at any given moment is necessarily an approximation. Therefore, any figures publicly presented should be interpreted as educated estimates rather than definitive values.

Future Projections: Growth Potential and Inherent Uncertainties

Predicting Damani's future net worth is, by nature, speculative. However, considering DMart's sustained growth and Damani's consistent investment prowess, a further increase in his net worth seems plausible. However, unforeseen economic disruptions or global events could certainly influence this trajectory. It’s a dynamic realm with both immense potential for growth and the inherent risk of unexpected setbacks.

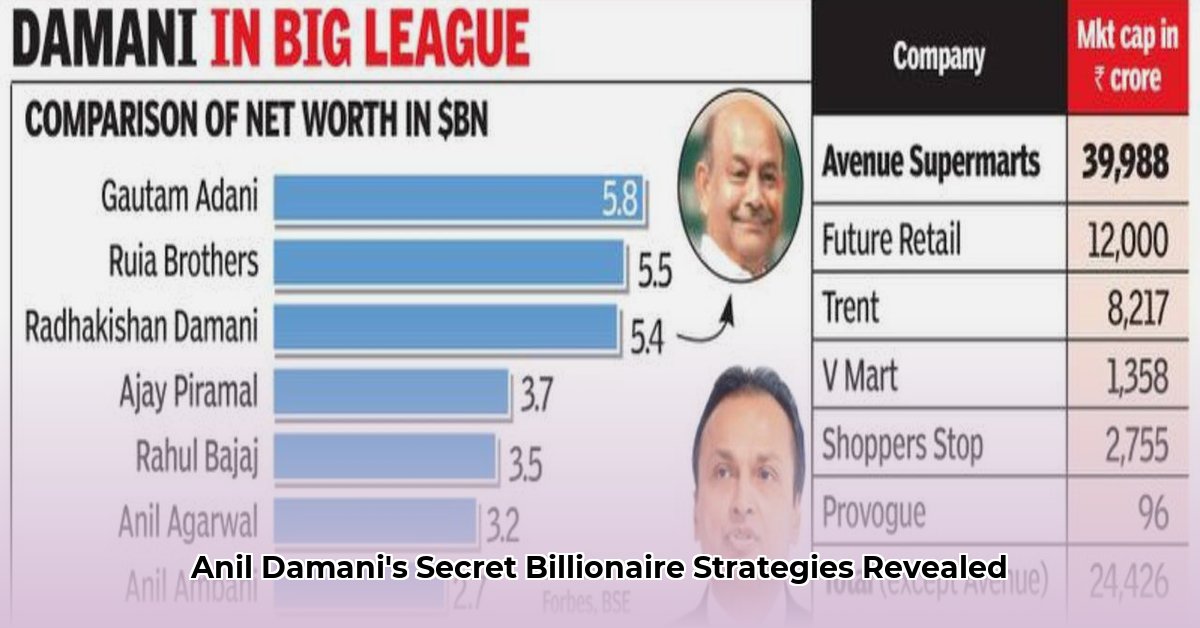

Comparative Analysis: Damani in the Context of Other Indian Titans

Comparing Anil Damani to other prominent Indian investors reveals the diverse paths to significant wealth accumulation.

| Investor | Primary Wealth Source | Investment Style | Publicly Traded? |

|---|---|---|---|

| Anil Damani | Avenue Supermarts (DMart), Investments | Value Investing, Long-Term Focus | No |

| Mukesh Ambani | Reliance Industries | Diversified Conglomerate | Yes |

| Rakesh Jhunjhunwala | Stock Market Investments | Value Investing, Long-Term Focus | Yes (indirectly) |

This comparison emphasizes the variety of approaches to wealth generation. While all three investors demonstrate a commitment to long-term strategic investing, their primary assets and approaches differ substantially.

Conclusion: The Enduring Legacy of Patience and Calculated Risk

The ambiguity surrounding Anil Damani's precise net worth underlines his successful long-term value investing approach. His wealth isn't a product of short-term gains but a culmination of years of diligent, patient, and strategically calculated decisions. While a definitive figure remains elusive, Damani’s story serves as a testament to the power of consistent, disciplined investing. Further research into his private holdings may eventually shed more light on the full extent of his financial empire.